Irs Schedule Se 2024 Instructions – Taxpayers could have started filing their taxes for the 2023 tax year on Jan. 29.. You can use the schedule chart below to estimate when you can expect to receive your refund based on when you . This part of the year brings a unique focus for those keeping an eye on their taxes, often juggling dual objectives. You might find yourself preoccupied with readying and submitting your 2023 tax .

Irs Schedule Se 2024 Instructions

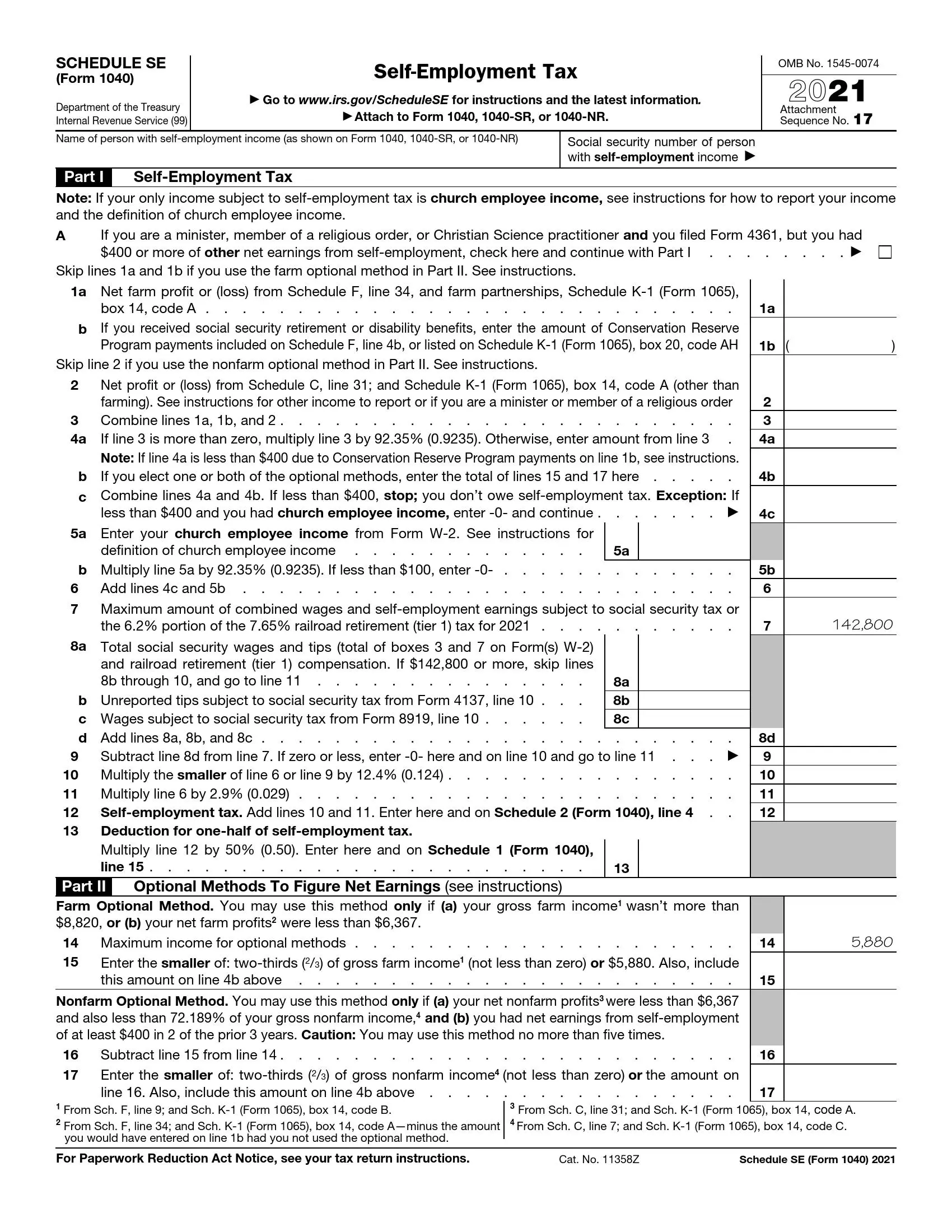

Source : www.irs.govIRS Releases Updated Schedule SE Tax Form and Instructions for

Source : www.abc27.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2023 Form IRS Instruction 1040 Schedule SE Fill Online

Source : tax-form-1040-instructions.pdffiller.com2023 Instructions for Schedule C

Source : www.irs.gov1040 (2023) | Internal Revenue Service

Source : www.irs.govAmazon.com: 1040 U.S. Individual Income Tax Return 2023: includes

Source : www.amazon.comIRS Instruction 1040 Schedule SE 2020 2024 Fill out Tax

Source : www.uslegalforms.com1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS Schedule SE Form 1040 ≡ Fill Out Printable PDF Forms Online

Source : formspal.comIrs Schedule Se 2024 Instructions 2023 Instructions for Schedule SE: According to the IRS, 20% of eligible taxpayers don’t know about the Earned Income Tax Credit, yet it could add thousands of dollars in tax savings back into their pockets. . This tax break can be claimed on Schedule 1, Line 21. And it doesn’t matter who the loan was for. Self-employment taxes might come as a bit of a surprise, but everyone has to pay Social Security .

]]>